Filing Fees

Filing Fees

USCIS FILING FEES

For the most up-to-date information make sure to check the comprehensive list of fees by viewing, Fee Schedule, Form G-1055.

USCIS Frequently Asked Questions About Filing Fees Webpage

07/31/2024 04:27 PM EDT

Edition Date: 07/31/24. You can find the edition date at the bottom of the page of Form G-1055, Fee Schedule.

USCIS FEE SCHEDULE - Form G-1055

updated July 31, 2024

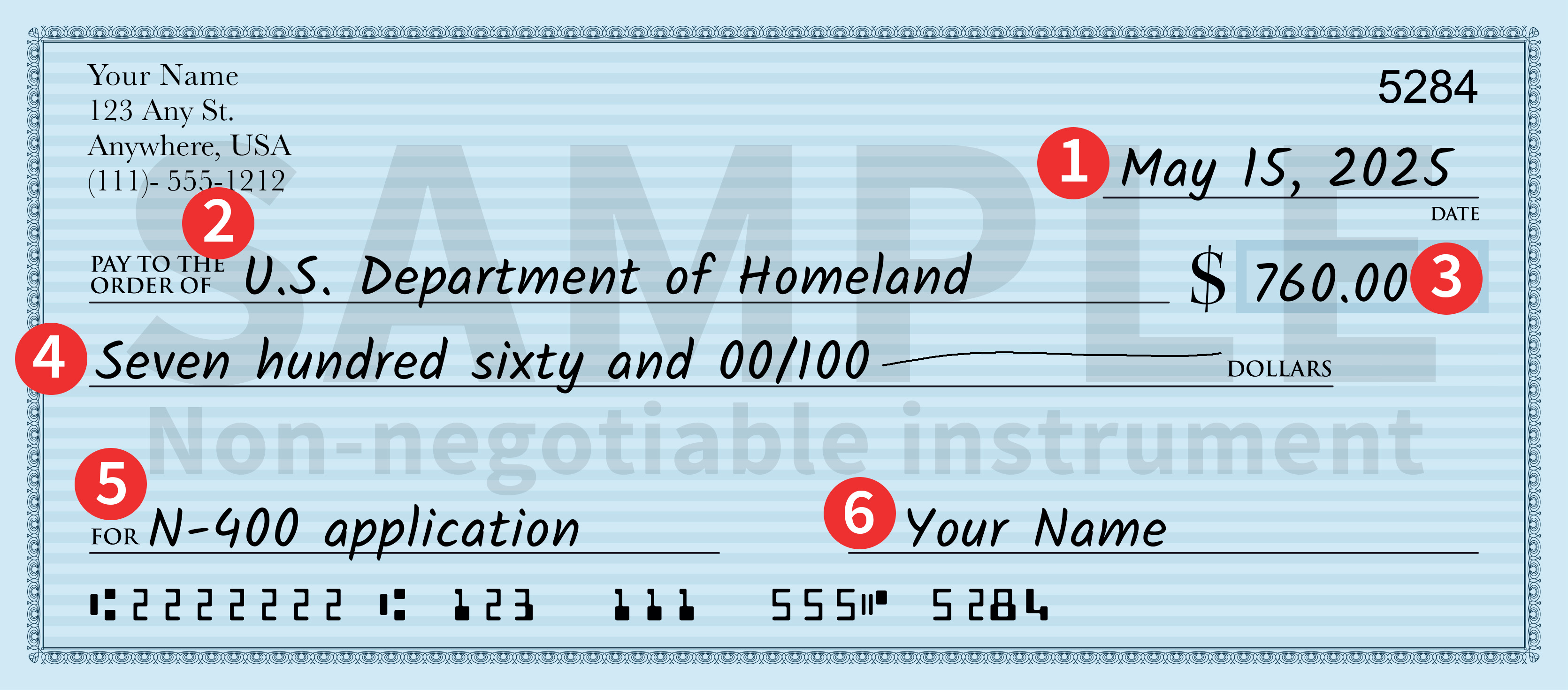

HOW TO WRITE CHECK

How to Write Your Check

Personal checks must be preprinted with your name and your bank’s name. Your address and phone number must be preprinted, typed, or written in ink.

- Write the date you are completing the check. Use the U.S. style of month/day/year. (Example: Jan. 4, 2017, or 1/4/17, but not 4/1/17 or 4 JAN 2017.)

- On the “Pay to the Order of” line, write “U.S. Department of Homeland Security” (not “USDHS” or “DHS”).

- Use numerals to show the exact dollar amount of the fee for the service you are requesting. In the example, the amount is “$760.00.”

- Spell out the exact dollar amount of the fee and write the “cents” portion of the amount as a fraction over 100. In this example, the amount is “Seven hundred sixty and 00/100.”

- Write a brief description of the purpose of your payment. In this example, it is “N-400 application.” Include the applicant’s name on the memo line if it is not on the check itself (for example, if you are paying the fee for your child).

- Sign the check in ink using your legal name.

- If your check is not dated within the previous 365 days, we will reject the filing.

PAYING BY CREDIT CARD

Pay with a Credit or Debit Card

If paying by credit or debit card, you must pay each filing fee separately for each application, petition, or request you submit.

You may pay filing and any other applicable fees with a credit or debit card issued by a U.S. bank if you are filing:

- An application, petition, or request with a USCIS lockbox; or

- An application, petition, or request with the USCIS service centers.

There is no additional cost if you pay by credit or debit card. We cannot accept a credit or debit card issued by a foreign bank.

Acceptable Credit or Debit Cards

You may use Visa, MasterCard, American Express, Discover, and prepaid cards from the same card networks. Make sure the card’s credit limit can cover the fee. We will reject your application, petition, or request if the card is declined, and we will not attempt to process your credit card payment a second time.

We do not support payment by gift cards.

How to Pay with a Card When Filing by Mail

To pay with a card, follow these two steps:

- Complete and sign Form G-1450, Authorization for Credit Card Transactions (PDF, 261.57 KB).

- Place the form on top of your application, petition, or request when you file it.

When filing Form G-1450 with a Lockbox or Service Center, you may split the payment for one form across multiple credit, debit, or prepaid cards that add up the correct total. Complete one Form G-1450 for each card. However, you may use only one Form G-1450 when requesting emergency advance parole from a USCIS field Office. In all cases, the credit, debit, or prepaid card must be from a financial institution located in the United States.

If we accept your filing, we will charge your card for the proper amount and destroy your Form G-1450 to protect your card information. (We will destroy it even if we reject your filing and do not process your payment.)

You will see a charge from USCIS on your credit card statement.

There is a daily transaction limit for credit cards of $24,999.99 per credit card per day set by the Department of the Treasury. We allow an exemption to this limit of up to $99,999.99 for H-1B registrations and petitions submitted online using one credit card.

Security

We use the U.S. Department of the Treasury’s Pay.gov Trusted Collections Service to process your credit card payment. Trusted Collections Service is a web-based application that allows government agencies to process debit or credit card payments. You cannot pay the fee directly to Pay.gov.

The Department of the Treasury ensures that Pay.gov is Payment Card Industry Data Security Standard compliant. This security standard is a set of requirements designed to ensure all companies processing, storing, or transmitting credit card information maintain a secure environment.

For your security, we will destroy your Form G-1450 after processing it, regardless of whether we accept or reject your application, petition, or request.

Third-Party Payments

Declined Credit Cards

If a credit card is declined, we will not attempt to process the credit card payment again. We will reject your application, petition, or request for lack of payment.

Rejection Notices

If we reject your filing, we will send you a notice explaining why we rejected it.

If you file a corrected application, petition, or request, and wish to pay again by credit card, you will need to include a new Form G-1450.

IF YOU FILE ONLINE

If you file your form online, the system will guide you through the process of paying your fees with a credit, debit, or prepaid card. Bank account withdrawals are also available when paying online. Once you are ready to submit your form, the system will automatically direct you to the secure Department of the Treasury site, pay.gov, to pay your fees online.

We only use pay.gov to process fees. Always check the website address before you pay. Beware of scam websites and scammers who may pretend to be a USCIS website.

IF YOU FILE BY MAIL

If you mail your form to a USCIS Lockbox facility, you may pay your fees with a debit, credit, or prepaid card. To do so, follow these steps:

- Complete and sign Form G-1450, Authorization for Credit Card Transactions.

- Place the form on top of your application, petition, or request.

- Mail the entire package to the appropriate USCIS Lockbox.

If we accept your filing, we will:

- Charge your card for the proper amount; and

- Destroy your Form G-1450 to protect your credit information (we will destroy it even if we reject your filing and do not process your payment).

You will see a charge from USCIS on your card statement.

For general filing information, see the Form Filing Tips webpage

UNFUNDED OR DISHONORED PAYMENTS

If we approve your petition, application, or request and the payment has not been properly funded or you subsequently dispute payment of the fee, we may revoke, rescind, or cancel the approval with notice (for example, by issuing a Notice of Intent to Revoke). We will not separately bill you for the unpaid fee. If you receive a Notice of Intent to Revoke, you may respond with payment of the correct fee amount.

from uscis.gov

REFUND

When you send a payment, you agree to pay for a government service. Filing and biometric service fees are final and nonrefundable, regardless of any action we take on your application, petition, or request, or if you withdraw your request. Please refer to the form you filed for additional information, or you may call the USCIS Contact Center at 800-375-5283 (for people who are deaf, hard of hearing, or have a speech disability: TTY 800-767-1833).

from uscis.gov

N-400 Filing Fee

FOR INFORMATION ABOUT N-400 FILING FEE WAIVERS Checkout the Filing Fee Waiver Page or the USCIS page for it (https://www.uscis.gov/i-912). A Form I-912 Application for a Filing Fee Waiver is separate and distinct from the reductions discussed here. Form I-912 information is not included here. 💸N-400 REDUCED FEE

SUMMARY OF N-400 FILING FEE

Full Filing Fee ($710-760)

Reduced Fee ($380)

< 400% of the HHS Poverty Guidelines [table here]

Must clearly show that your documented annual household income is less than 400% of the Federal Poverty Guidelines (https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines)

Eligibility

You can request a reduced fee if:

- You are filing a paper Form N-400, Application for Naturalization;AND

- You provide documentation showing you qualify because your documented household income is less than 400% of the Federal Poverty Guidelines at the time you file. Check the current eligible income levels based on the Federal Poverty Guidelines for this year.

NEW N-400 FILING FEE (2024)

The new fee rule is consistent with this longstanding practice, as indicated in the table below. Previously, the total cost included both an application fee ($640) and a separate biometric services fee ($85), for a total of $725 for most applicants. Under the new fee rule, there is no longer a separate biometric services fee, and the total fee is $710 for online filers or $760 for paper filers.

The new fee rule also provides a reduced naturalization fee ($380) for applicants with a household income at or below 400% of the Federal Poverty Guidelines (FPG), expanding eligibility for this reduced fee. Under the previous fee schedule, this reduced fee was only available to applicants with a household income between 150% and 200% of the FPG.

| N-400, Application for Naturalization, including biometric services | Previous fee(s) | Final rule fee(s) | $ change | % change |

|---|---|---|---|---|

Household income greater than 400% of the (FPG) (paper filing) | $725 | $760 | $35 | 5% |

Household income greater than 400% of the FPG (online filing) | $725 | $710 | -$15 | -2% |

Household income between 150-200% of the FPG | $405 | $380 | -$25 | -6% |

Household income between 200-400% of the FPG | $725 | $380 | -$345 | -48% |

N-400 REDUCED FEE

The reduced fee for Form N-400 will be $380 as of April 1, 2024.

Note the new fee rule edition of Form N-400 incorporates in Part 10 a request for a reduced fee based on household income, eliminating the need to submit Form I-942, Request for Reduced Fee, which is being discontinued.

You cannot file online if you are requesting a reduced fee; you must file a paper Form N-400.

If you are applying for a reduced fee, select “Yes” in Part 10, Item Number 1, then complete Part 10, and submit $380 and documentation to support the reduced fee.

FILING N-400 WITH REQUEST FOR REDUCED FEE

An applicant submitting a request for a fee waiver should submit Form N-400 along with Form I-912 (or a written request) and without a fee.

You cannot file online if you are requesting a fee waiver; you must file a paper Form N-400.

If you are applying for a fee waiver, you are not required to completed Part 10 of the Form N-400. Do not send a fee. Submit a properly completed Form I-912, or a written request for a fee waiver, and documentation to support the fee waiver request.

An applicant requesting a reduced fee with Form N-400 on or after April 1, 2024, should submit the new Form N-400 with Part 10 complete and pay the amount of the reduced fee ($380).

If an applicant were to submit the correct reduced fee with their N-400 and also filed the Form I-912 fee waiver request, we would accept the fee and not adjudicate the fee waiver request.

<aside> <img src="/icons/error_red.svg" alt="/icons/error_red.svg" width="40px" /> An applicant cannot request a reduced fee if filing an N-400 online.

</aside>

How to show that your household income is greater than 400% of the Federal Poverty Guidelines

- You may request a reduced fee for the filing fees of the application if your documented annual household income is less than 400% of the Federal Poverty Guidelines at the time you file.

- If your income is at or below 150% of the Federal Poverty Guidelines, do not file a request for a reduced fee. You may file a fee waiver request. See Form I-912, Request for Fee Waiver.

- If you are requesting a reduced fee while your spouse lives outside the United States and provides support to your household, include your spouse’s contributions to your household under total household income. If your spouse lives outside the United States and provides no support to your household, please include a statement explaining the situation. If you are applying on the basis of being a battered or abused spouse of a U.S. citizen who you continue to reside with, do not include that spouse’s income.

WHO COUNTS AS PART OF YOUR HOUSEHOLD?

You count someone as part of your household size if that person is:

- You;

- The head of your household (if not you). If a child (under 21 years of age) is applying individually, provide the information of the primary custodial parent;

- Your spouse living with you (if you are separated or your spouse is not living with you, do not include your spouse); or

- Any of the following family members who live with you:

- Your children or legal wards, who are unmarried and under 21 years of age;

- Your children or legal wards, who are unmarried and are at least 21 years of age but under 24 years of age, are full-time students, and who live with you when not at school;

- Your children or legal wards, who are unmarried and for whom you are the legal guardian because they are physically or developmentally disabled or mentally impaired to the extent that they cannot adequately care for themselves and cannot establish, maintain, or re-establish their own household;

- Your parents; and

- Any other dependents listed on your federal tax return, or on your spouse’s (unless separated or not living with you) or head of household’s federal tax returns.

- You must include the annual income of your household members as part of your household income.

My relative or roommate lives with me, does their income count toward my household income?

- If someone lives with you but does not meet the definition of a household member as described above, do not count that person’s income as part of your household income. You should count the specific amount of any financial contribution that you receive from them only if that money was used to support your household. You include that amount in your total household income.

- Example 1: If your uncle lives in your house (which you own) and paid $1,000 towards your mortgage, that $1,000 would be included as income because it was financial support provided to your household.

- Example 2: You share an apartment with a roommate who is not a household member. You pay your own expenses, and your roommate pays their own expenses. Your roommate’s income is not part of your household income because the roommate is not financially supporting you. Therefore, you do not include the roommate’s income as part of your household income.

I receive child support, but not the full amount as listed in the court order. Do I include the full amount of the child support as additional income or financial support or only what I actually receive?

- Annotate the actual amount of child support received. If there is a difference between what is stated in a court order or documentation, provide an explanation. Examples of documents may include bank statements, copies of checks, court documents, or other documentation indicating the actual income or financial assistance you are receiving.

How marital separation affects eligibility

- If you are requesting a reduced fee and are not including your spouse’s income because of a marital separation, please provide a signed statement or documentation to establish that your spouse does not live with you and provides no income assistance. Acceptable documents may include a copy of the court order that formalized your legal separation, a formal notarized property settlement agreement, financial support agreement, or separate mortgage, lease, or utility bills that show you and your spouse live apart.

- Even if you are separated from your spouse, your household income includes any monthly support payments that you receive from your spouse.

Common reasons why USCIS will reject reduced fee requests

- You did not provide evidence that your household income that is less than 400% of the Federal Poverty Guidelines; or

- You submitted evidence in support of your reduced fee request that is not in English, but you did not provide a certified English translation.

- If we denied your reduced fee request and you are not sure why, please read the denial notice (Form I-797, Notice of Action). If, after checking the denial notice, you still do not understand why we denied your reduced fee request, you may email us at lockboxsupport@uscis.dhs.gov.

LINKS

How to Calculate Household Size

Fee Waivers

USCIS FEE WAIVERS

- How to request a fee waiver;

- Which fees are waivable;

- Which filing fees can't ever be waived;

- Filing fee amounts.

Three Basis for Fee Waiver

USCIS evaluates whether the requestor is unable to pay the filing fee based on the following criteria:

- The requestor or qualifying member of the requestor’s household is receiving a means-tested benefit;

- The requestor’s household income level is at or below 150 percent of the Federal Poverty Guidelines (FPG ); or

- The requestor is experiencing extreme financial hardship due to extraordinary expenses or other circumstances that render the individual unable to pay the fee.

An officer must evaluate whether the requestor establishes an inability to pay under any of these three criteria.

LAW & STANDARD

See 8 CFR 106.3 .

See Section D, Basis for Inability to Pay [1 USCIS-PM B.4(D) ]. See Matter of Chawathe (PDF) , 25 I &N Dec. 369 (AAO 2010) (identifying preponderance of the evidence as the standard for immigration benefits generally, and in that case specifically naturalization).

*See Matter of Chawathe (PDF)* , 25 I &N Dec. 369, 376 (AAO 2010) (preponderance of the evidence means more likely than not). See U.S. v. Cardozo-Fonseca , 480 U.S. 421 (1987) (defining “more likely than not” as a greater than 50 percent probability of something occurring).

What Fees Are Eligible for a Fee Waiver?

The following table provides a list of forms for which USCIS may waive the fees based on a requestor’s inability to pay.

Application to Replace Permanent Resident Card (Form I-90)

Application for Relief Under Former Section 212(c) of the Immigration and Nationality Act (INA) (Form I-191)

Petition to Remove Conditions on Residence (Form I-751)

Application for Family Unity Benefits (Form I-817)

Application for Temporary Protected Status (Form I-821)

Application for Suspension of Deportation or Special Rule Cancellation of Removal (Form I-881)

Application to File Declaration of Intention (Form N-300)

Request for a Hearing on a Decision in Naturalization Proceedings (Form N-336)

Application for Naturalization (Form N-400)

Application to Preserve Residence for Naturalization Purposes (Form N-470)

Application for Replacement of Naturalization/Citizenship Document (Form N-565)

Application for Certificate of Citizenship (Form N-600)

Application for Citizenship and Issuance of Certificate under Section 322 (Form N-600K)

Conditional Fee Waivers

Certain fee waivers depend on specific conditions. The following table provides a list of forms for which USCIS may waive fees based on the requestor’s inability to pay and if they meet the specified conditions.

Petition for a CNMI-Only Nonimmigrant Transitional Worker (Form I–129CW) petitioning for an E–2 CNMI investor

Application to Extend/Change Nonimmigrant Status (Form I–539), only in the case of a noncitizen applying for CW–2 nonimmigrant status

Application for Travel Document (Form I-131) for those applying for humanitarian parole

Application for Advance Permission to Enter as Nonimmigrant (Form I-192) for an applicant who is exempt from the public charge grounds of inadmissibility

Application for Waiver of Passport and/or Visa (Form I-193) for an applicant who is exempt from the public charge grounds of inadmissibility

Notice of Appeal or Motion (Form I-290B) if the underlying benefit request was fee exempt, the fee was waived, or it was eligible for a fee waiver

Application to Register Permanent Residence or Adjust Status (Form I-485) for an applicant who is exempt from the public charge grounds of inadmissibility

Petition for a CNMI-Only Nonimmigrant Transitional Worker, or an Application to Extend/Change Nonimmigrant Status (Form I-539) for an applicant applying for CW-2 nonimmigrant status

Application for Waiver of Grounds of Inadmissibility (Form I-601) for an applicant who is exempt from the public charge grounds of inadmissibility

Notice of Appeal of Decision Under Sections 210 or 245A of the Immigration and Nationality Act (

Form I-694) if the underlying application or petition was fee exempt, the filing fee was waived, or was eligible for a fee waiver

Application for Employment Authorization (Form I-765), except persons filing under category (c)(33), Deferred Action for Childhood Arrivals (DACA)

For the following forms if the applicant is exempt from public charge ground of inadmissibility under INA 212(a)(4):

- Application for Advance Permission to Enter as Nonimmigrant (Form I-192);

- Application for Waiver for Passport and/or Visa (Form I-193);

- Application to Register Permanent Residence or Adjust Status (Form I-485); and

- Application for Waiver of Grounds of Inadmissibility (Form I-601).

Humanitarian Fee Waivers

USCIS provides fee exemptions for many forms filed by certain humanitarian categories of requestors. If not otherwise exempt from paying the fee, an individual may request a fee waiver for any application or petition that is related to any of the following humanitarian categories:

- Battered spouses of A, G, E-3, or H nonimmigrants;

- Battered spouses or children of a lawful permanent resident or U.S. citizen under INA Section 240A(b)(2);

- T nonimmigrants;

- Temporary Protected Status (TPS);

- U nonimmigrants;

- VAWA self-petitioners and derivative(s);

- Conditional permanent residents (CPRs) filing a waiver of the joint filing requirement based on battery or extreme cruelty;

- Abused spouses and children adjusting status under the Cuban Adjustment Act (CAA) and Haitian Refugee Immigration Fairness Act of 1998 (HRIFA);

- Abused spouses and children seeking benefits under Nicaraguan Adjustment and Central American Relief Act (NACARA);

- Special immigrant juveniles;

- Asylees; or

- Refugees

Fee Exemption vs. Fee Waiver

A fee exemption means that we do not require a fee for a form or do not require a certain category of requestors to pay the prescribed fee for a form. You can find all current fee exemptions on our Fee Schedule page. If a fee exemption applies to you and the form you are submitting, you do not need to request a fee waiver or pay the filing fee.

A fee waiver means that we require a fee for a form but waive this requirement for an individual requestor because of their inability to pay the fee. If you request a fee waiver and show us that you are eligible, then you will not need to pay the filing fee for the associated form. However, if you request a fee waiver and we find that you are not eligible, then we may reject your fee waiver request and underlying application or petition.

Eligibility for a Fee Waiver

You can request a fee waiver if:

- The form you are filing is eligible for a fee waiver and you meet any applicable conditions (see our Fee Schedule page); and

- You provide documentation showing that you qualify based upon one of the following criteria:

- You, your spouse, your child, your parent (if you are under 21 or disabled), or your sibling (if you and the sibling are under 21) living with you, are currently receiving a means-tested benefit.

- Your household income is at or below 150% percent of the Federal Poverty Guidelines at the time you file.

- You are currently experiencing extreme financial hardship, including hardship from unexpected medical bills or emergencies, that prevents you from paying the filing fee.

See the USCIS Fee Waiver Policy.

Requesting a Fee Waiver

Complete the most current version of Form I-912, Request for Fee Waiver, or write a letter asking for a fee waiver and provide all the necessary information and supporting evidence to establish your eligibility under one of the three criteria listed above.

Please follow all instructions, complete all necessary sections of the forms, and submit proper documentation to avoid common rejection reasons.

Receipt of means-tested benefit

A means-tested benefit is a public benefit for which the agency granting the benefit considers your income and resources.

- The benefit may be federally, state, or locally, or tribally funded.

- In general, if you receive a public benefit that based on your income, we consider it that benefit a means-tested benefit.

Some public benefits that, for fee waiver purposes, we consider means-tested benefits include:

- Medicaid, Children's Health Insurance Program (CHIP), and State Children's Health Insurance Program (SCHIP);

- Supplemental Nutrition Assistance Program (SNAP, formerly called Food Stamps) and other similar food assistance programs;

- Temporary Assistance to Needy Families (TANF);

- Supplemental Security Income (SSI);

- Housing, Section 8 Housing Assistance under the Housing Choice Voucher program, Section 8 Project-Based Rental Assistance (including Moderate Rehabilitation), and Housing assistance under the McKinney-Vento Homeless Assistance Act;

- Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) and other childcare programs;

- Low Income Home Energy Assistance Program (LIHEAP) and other energy assistance programs;

- Any services provided under the Robert T. Stafford Disaster Relief and Emergency Assistance Act (Stafford Act); and

- Any cash benefit provided by the Department of Veterans Affairs or other federal or state, local, or tribal benefit based on veteran status.

For a more extensive list of eligible benefits, see USCIS Policy Manual Vol 1, Part B, Chapter 4, Fee Waivers and Fee Exemptions

If you are receiving a means-tested benefit that is not well known outside of your area, please provide as much information as you can about the benefit. This may include a brochure, contact information, or the website address of the agency granting the benefit.

Some benefits that, for fee waiver purposes, we do not consider means-tested benefits include:

- Medicare;

- Unemployment benefits;

- Social Security benefits;

- Social Security Disability Insurance (SSDI);

- Retirement, Survivors and Disability Insurance (RSDI); and

- Student financial aid, loans, and grants.

Using a family member’s means-tested benefits to qualify

- A requestor may use their spouse’s means-tested benefit to qualify for a fee waiver as long as they are residing with the spouse and are not legally separated.

- A child under 21 years of age may use a parent’s means-tested benefit to qualify for a fee waiver if the child currently lives in the same household as the parent.

- A college student (21 years of age or older) may not use a parent’s means-tested benefit. However, a college student can independently qualify for a fee waiver based on either financial hardship or household income below 150% of the Federal Poverty Guidelines.

- A child over 21 who is disabled and whose parent remains the child’s legal guardian or surrogate may use that parent’s means-tested benefit to qualify for a fee waiver. The adult child may have an assigned representative for the means-tested benefit. The parent or legal guardian may provide the information about the custody and the disability in the financial hardship section. Any information about the parent’s means-tested benefit can be included under the other parts of Form I-912 regarding financial hardship or income below 150% of the Federal Poverty Guidelines.

- A parent may use their child’s means-tested benefit to qualify for a waiver if the parent and child currently reside in the same household.

- A child may use the means-tested benefit of a sibling if both children are under 21 and live in the same household with a common parent.

- The requestor must provide evidence of the relationship to the family member receiving the means-tested benefit (for example, copy of marriage certificate for a spouse or copy of birth certificate if a child) as well as evidence they reside with the qualifying family member.

Documentation showing you are receiving a means-tested benefit

You must provide evidence that you (or your qualifying family member) are currently receiving a means-tested benefit. This evidence should be in the form of a letter, notice, or other official document that contains the required information, including:

- Your name (or the name of the family member receiving the benefit);

- The name of the agency granting the public benefit;

- The type of benefit; and

- An indication that you or your family member are receiving the benefit (for example, the date granted, expiration date, and/or date of renewal, if available)

What if I am currently receiving a means-tested benefit, but my documentation does not show an expiration date?

- If the document does not have an expiration date, we will review the date on the letter or issuance date to confirm it is within 12 months of the date you filed your Form I-912.

- The documentation provided should not be dated more than 12 months from the date you file Form I-912. If the documentation is more than 12 months old and you are still receiving the benefit, provide additional evidence that shows you are currently receiving the benefit.

Does my benefit card count as evidence that I am receiving a means-tested benefit?

- Benefit cards by themselves are not acceptable evidence of a means-tested benefit, unless they contain the recipient’s name, the name of the agency granting the public benefit, the type of benefit, and an indication that you or your family member currently receive the benefit (for example, the date you were granted the benefit and the date it expires or was renewed). States usually do not require applicants to return cards, without any value, after the expiration of benefits.

Household income is at or below 150% of the Federal Poverty Guidelines

- You may qualify for a fee waiver if your household income is at or below 150% percent of the Federal Poverty Guidelines when you file. Check the current poverty levels for this year at Poverty Guidelines.

- You must include the head of household’s income in your total household income. For the fee waiver request, the head of household includes, but is not limited to, the head of household as determined by the IRS for filing an IRS Form 1040 or the person that earns most of the income for your household. You can find more information about head of household when filing the IRS Form 1040 at http://www.irs.gov/publications/p501.

See how to calculate household size

Overseas Spouse

- If you are requesting a fee waiver based on household income that is at or below 150% of the Federal Poverty Guidelines and your spouse lives overseas and provides support to your household, include your spouse’s contributions to your household in the total additional income or financial support section. If your spouse living overseas is unemployed and is supported by you, state that on the form. If your spouse lives overseas and provides no support to your household, please include a statement explaining the situation.

Lack of Stable Address

- We will consider lack of stable address when reviewing a fee waiver request. If you receive services from a homeless shelter, please include a currently dated letter from the shelter. The letter should be on the shelter’s letterhead, include a statement that you receive services from the shelter, and be signed by a shelter employee attesting to your situation. If you are homeless but do not reside in a shelter, please include an affidavit from a member of good standing in your community who knows you and can support your claim that you are homeless and unable to pay the fee(s).

Determining who counts toward your household size and income

- You count someone as part of your household size if that person is:

- You;

- The head of your household (if not you). If the child (under 21 years of age) is applying individually, provide the information of the primary custodial parent;

- Your spouse living with you (if you are separated or your spouse is not living with you, do not include your spouse); or

- Any of the following family members who live with you:

- Your children or legal wards, who are unmarried and under 21 years of age;

- Your children or legal wards, who are unmarried and are at least 21 years of age but under 24 years of age, are full-time students, and who live with you when not at school;

- Your children or legal wards, who are unmarried and for whom you are the legal guardian because they are physically or developmentally disabled or mentally impaired to the extent that they cannot adequately care for themselves and cannot establish, maintain, or re-establish their own household;

- Your parents; and

- Any other dependents listed on your federal tax return, or on your spouse’s or head of household’s federal tax returns.

- You must include the annual income of your household members as part of your household income.

My relative or roommate lives with me, Does their income count toward my household income?

- If someone lives with you but does not meet the definition of a household member as described above, do not count that person’s income as part of your household income. You should count the specific amount of any financial contribution that you receive from them only if that money was used to support your household. You would list that amount under the additional income or financial support section.

- Example 1: If your uncle lives in your house (which you own) and paid $1,000 towards your mortgage monthly, that $1,000 would be included under additional income or financial support because it was financial support provided to your household.

- Example 2: You share an apartment with a roommate who is not a household member. You pay your own expenses, and your roommate pays his expenses. Your roommate’s income is not part of your household income because the roommate is not financially supporting you. Therefore, you do not include the roommate’s income as part of your household income.

I receive child support, but not the full amount as listed in the court order. Do I include the full amount of the child support as additional income or financial support or only what I actually receive?

- Annotate the actual amount of child support received. If there is a difference between what is stated in a court order or documentation, provide an explanation. Examples of documents may include bank statements, copies of checks, court documents, or other documentation indicating the actual income or financial assistance you are receiving.

How does my marital separation affect my eligibility for a fee waiver?

- If you are requesting a fee waiver based on income at or below 150% of the Federal Poverty Guidelines and are not including your spouse’s income because of a marital separation, please provide a signed statement or documentation to establish that your spouse does not live with you and provides no income assistance. Acceptable documents may include a copy of the court order that formalized your legal separation, a formal notarized property settlement agreement, financial support agreement, or separate mortgage, lease, or utility bills that show you and your spouse live apart.

- Even if you are separated from your spouse, your household income includes any monthly support payments that you receive from your spouse.

Extreme Financial Hardship

Some examples of extreme financial hardship include:

- A medical emergency or illness affecting the noncitizen or the noncitizen’s dependents;

- Unemployment;

- Significant loss of work hours and wages (change in employment status);

- Eviction;

- Homelessness;

- Military deployment of spouse or parent;

- Natural disaster;

- Loss of home (destruction such as fire, water, or collapse);

- Inability to pay basic utilities and rent or mortgage (payments and bills for each month are more than the monthly wages);

- Substantial financial losses to small business that affects personal income;

- Victimization;

- Divorce or death of a spouse that affects overall income; or

- Other situations that could not normally be expected in the regular course of life events.

How to show that you are experiencing extreme financial hardship

- Include a detailed description of why you have extreme financial hardship on the form and provide evidence, including:

- Documentation of income, as provided above;

- Documentation of all assets owned, possessed, or controlled by you and your dependents; or

- Documentation concerning liabilities and expenses owed by you and your dependents, and any other expenses for which you are responsible.

- Examples of evidence that may support your detailed description of extreme financial hardship include:

- Bank statements;

- Pay stubs or proof of unemployment;

- Utility bills;

- Rental agreements;

- Medical bills; and

- Proof of unstable housing or homelessness.

What if I do not have access to documentation that shows my extreme financial hardship?

- If you cannot provide evidence of extreme financial hardship, include in your description an explanation of why you cannot provide evidence. It is always advisable to include an affidavit (signed and dated) from a member of good standing in your community who knows you and can provide more insight into your current financial situation.

- If you lost all forms of evidence in a natural disaster, fire, robbery, or through other means, include an explanation in your description. Please provide a copy of a police report, insurance claim or other report, if available, to support your claim.

How requesting a fee waiver affects your current immigration status

- For purposes of admission to the United States, USCIS considers current and/or past receipt of public cash assistance for income maintenance and long-term institutionalization at government expense in the totality of the circumstances, taking into account the amount, duration, and recency of the receipt. Current and/or past receipt of benefits alone, however, is not a sufficient basis to determine whether an applicant is likely at any time to become a public charge.

- The receipt of public benefits does not negatively affect the review of the fee waiver request.

You can find detailed guidance on these issues in Volume 8, Part G of the USCIS Policy Manual. Additional information is also available on our Public Charge Resources page.

- USCIS will deny your underlying application or petition if they determine that it involves false documentation, misrepresentation of facts, or other fraud, including fraud on a fee waiver request.

COMMON REASONS WHY USCIS WILL REJECT A FEE WAIVER REQUEST

- The form for which you are making the request is not eligible for a fee waiver, or you do not meet the conditions for eligibility.

- You (the requestor) did not sign Form I-912 or the written request, or, if you are under 14, your parent or legal guardian also did not sign.

- You failed to check at least one box in Part 1 of Form I-912 or otherwise indicate your basis for requesting a fee waiver.

- You did not provide evidence that:

- You are currently receiving a means-tested benefit;

- Your household income is at or below 150% percent of the Federal Poverty Guidelines; or

- You are currently experiencing extreme financial hardship.

- You submitted evidence in support of your fee waiver request that is not in English, and you did not provide a certified English translation.

- You submitted Form I-912 or a written request without the petition or application form.

- You did include a full English translation for all documents that have information in a foreign language.

- If we denied your fee waiver and you are not sure why, please read the denial notice (Form I-797, Notice of Action). If, after checking the denial notice, you still do not understand why we denied your fee waiver request, you may email us at lockboxsupport@uscis.dhs.gov.

Financial Assistance Considered Income In Fee Waiver Request

To establish the total income, a request must include any additional financial assistance (not otherwise included in a tax return or W-2) including any Social Security income (as reflected on the SSA-1099) to the adjusted gross income in the tax return.

The table below includes some types of additional financial assistance that USCIS considers household income for a fee waiver request. The requestor must provide documentation of each type of additional financial assistance that applies.

Additional Financial Assistance

- Parental support

- Child support

- Pensions

- Royalties

- Unemployment benefits

- Alimony

- Educational stipends

- Social Security

- Veterans benefits

- A court order granting any child support or documentation from an agency providing other income or financial assistance

- Consistent or regular financial support from adult children, parents, dependents, or other people living in the applicant’s household

DOCUMENTING FINANCIAL HARDSHIP

| Assets | Liabilities |

|---|---|

Real estate | Medical expenses |

Cash | Child care and elder care |

Checking and savings accounts and | Monthly utility bills |

Stocks, bonds, and annuities (except for pension plans, Individual Retirement Accounts (IRAs), and other retirement funds) | Rent or Mortgage |

Taxes | |

Property maintenance | |

Monthly payments of lawful debts | |

Tuition costs | |

Commuting costs |

In general, if a requestor provides proof of inability to pay the fee based on financial hardship, the request for fee waiver may be approved on this basis and no further information is required.

Provide documentary evidence of any claimed expense mentioned in your request. Show how your documented income is spent on your documented expenses and leaves no remaining money that could be used to pay the filing fee.

WHAT IF THE REQUESTOR HAS NO INCOME?

If the requestor has no income due to unemployment, homelessness, or other factors, the requestor may provide, as applicable:

- A detailed description of the financial situation that demonstrates eligibility for the fee waiver;

- Hospital bills;

- Bankruptcy documents;

- If the requestor is receiving support services, an affidavit from a religious institution, non-profit, hospital, or community-based organization verifying the person is currently receiving some benefit or support from that entity and attesting to the requestor’s financial situation; or

- Evidence of unemployment, such as a termination letter or unemployment insurance receipt.

An officer may grant a request for fee waiver in the absence of some of this documentation, as long as the available documentation supports that the requestor is more likely than not unable to pay the fee.

VAWA, T, and U-Based Requestors

USCIS considers whether a requestor is unable to obtain proof of income due to alleged victimization such as trafficking or abuse. If not otherwise eligible for a fee exemption, the requestor should describe the situation in the Form I-912 or written request to substantiate the inability to pay as well as the inability to obtain the required documentation.

The requestor should provide any available documentation, such as affidavits from religious institutions, non-profits, or other community-based organizations verifying that the requestor is currently receiving some benefit or support from that entity and attesting to the financial situation.

VAWA, T, and U-Based Requestors

Requestors seeking a fee waiver for any immigration benefit associated with or based on a pending or approved petition or application for VAWA benefits [28] or T or U nonimmigrant status that are not otherwise fee exempted do not need to list as household members or provide income information for the following people:

- Any person in the household who is or was the requestor’s abuser, human trafficker, or perpetrator; or

- A person who is or was a member of the abuser, human trafficker, or perpetrator’s household.

In addition, such requestors do not need to list their spouse as a household member or include their spouse’s income in the fee waiver request.

If a VAWA self-petitioner or recipient [29] (or their derivative(s)) or applicant, petitioner, or recipient of T or U nonimmigrant status does not have any income or cannot provide proof of income, the requestor may:

- Describe the situation in sufficient detail in the fee waiver request to substantiate lack of income or income at or below 150 percent of the FPG, as well as the inability to obtain the required documentation; and

- Provide any documentation of the income, such as pay stubs or affidavits from religious institutions, non-profits, or other community-based organizations, verifying that the requestor is currently receiving some benefit or support from that entity and attesting to the financial situation, if available.

Special Immigrant Juveniles

A petitioner or recipient of Special Immigrant Juvenile (SIJ) classification who files a fee waiver request for a filing not otherwise fee exempted does not need to provide proof of income. USCIS considers requestors in this category as part of their own household, without including any foster or group home household members.

Instead of proof of income, the fee waiver request must include documentation showing that the requestor has an approved petition for SIJ classification (for example, a copy of Notice of Action (Form I-797) for Form I-360).

Emergent Circumstance

Natural catastrophes and other extreme situations [link] beyond a person’s control may affect the ability to pay USCIS fees. Based on the USCIS Director’s authority to waive a required fee, [link] USCIS may designate certain time periods or events in which a person may file a fee waiver request when not otherwise eligible. [link]

In such cases, the requestor must still file a fee waiver request and establish eligibility under one of the criteria (generally, financial hardship). USCIS may accept the request based on the requestor’s statement even if there is no documentation of the emergencies and unforeseen circumstances.

Unless otherwise eligible, requestors may only seek a fee waiver under those emergent circumstances described in the Immigration Relief in Emergencies or Unforeseen Circumstances webpage.

FEE REQUEST LINKS

Forms

Handouts

- Guidance on Requesting a Fee Waiver for your Form I-765, Application for Employment Authorization (PDF, 147.15 KB)

- Guidance on Requesting a Fee Waiver for your Form I-765, Application for Employment Authorization (Spanish) (PDF, 150.3 KB)

- Guidance on Requesting a Fee Waiver for your Form I-765, Application for Employment Authorization (Haitian Creole) (PDF, 158.12 KB)

- Guidance on Requesting a Fee Waiver for your Form I-765, Application for Employment Authorization (Russian) (PDF, 208.18 KB)

- Guidance on Requesting a Fee Waiver for your Form I-765, Application for Employment Authorization (Ukrainian) (PDF, 164.25 KB)

- Guidance on Requesting a Fee Waiver for your Form I-765, Application for Employment Authorization (WOLOF) (PDF, 154.53 KB)

- Fact Sheet – Request for Fee Waiver or Form N-400 (PDF, 106.06 KB) (PDF, 145.8 KB)

- Fact Sheet – Promoting Citizenship for Low-Income (PDF, 152.48 KB)

- Fact Sheet – Promoting Citizenship for Homeless (PDF, 119.04 KB)